ConnectOne Bancorp (CNOB)·Q4 2025 Earnings Summary

ConnectOne Bancorp Beats on EPS as Net Interest Margin Widens 16 Basis Points

January 29, 2026 · by Fintool AI Agent

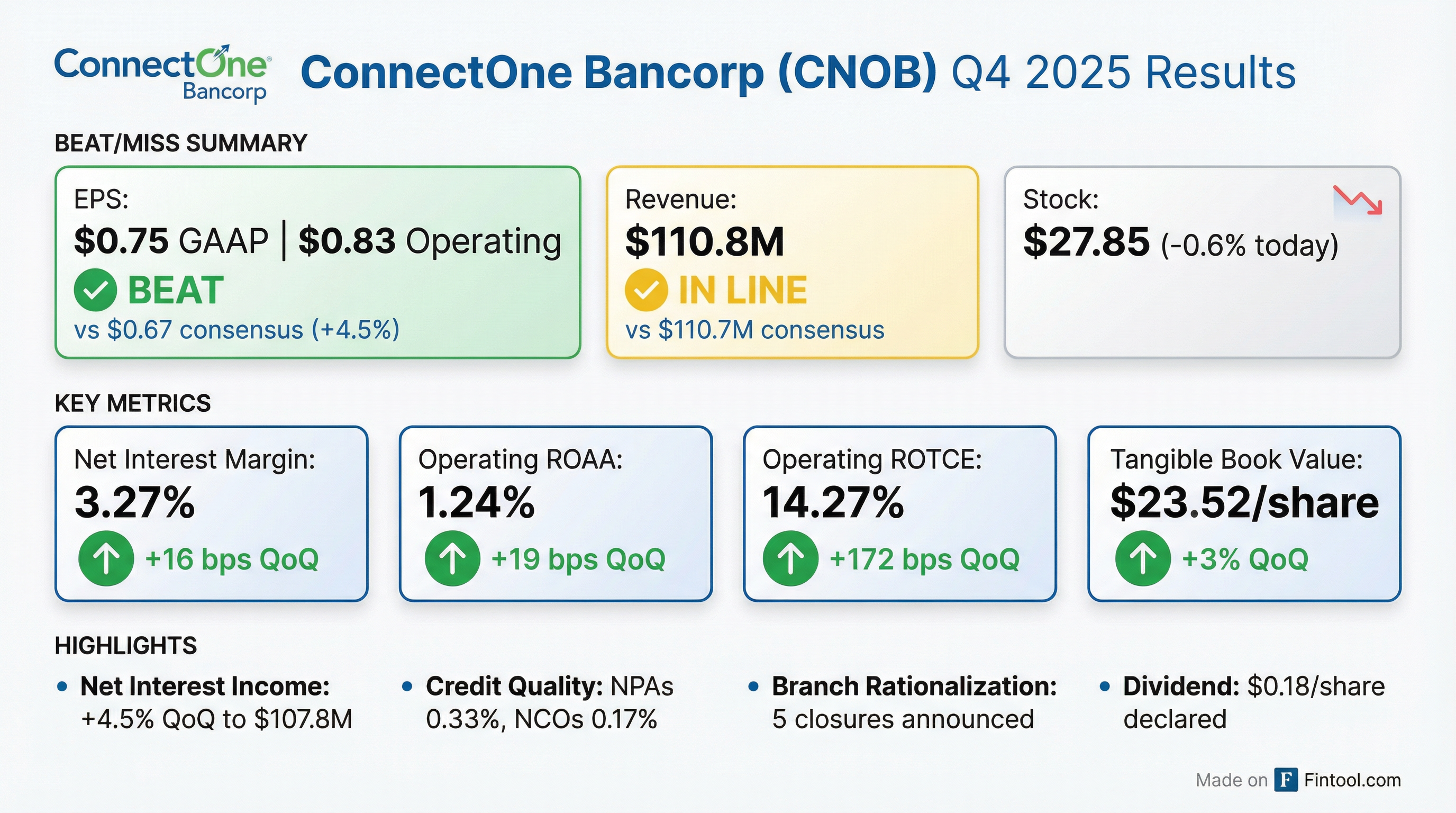

ConnectOne Bancorp (CNOB) delivered a solid Q4 2025, beating EPS estimates by 4.5% as net interest margin expanded 16 basis points sequentially to 3.27%. The regional bank reported diluted EPS of $0.75 (GAAP) and operating EPS of $0.83, with net income available to common stockholders of $38.0 million. Management announced 5 branch closures as part of ongoing franchise optimization following the FLIC merger integration.

Did ConnectOne Beat Earnings?

CFO Bill Burns highlighted the momentum: "We delivered another excellent quarter... operating earnings for the current quarter represented an 18.6% increase sequentially over the third quarter. This drove our quarterly operating return on assets all the way up to 1.24% and a return on tangible common equity to 14.3%."

The beat was driven primarily by:

- Net interest margin expansion: NIM widened 16 bps QoQ to 3.27%, benefiting from an 18 bps improvement in cost of interest-bearing deposits while loan yields held steady

- Lower provision: Credit loss provision dropped to $2.3M from $5.5M in Q3 2025

- Expense discipline: Noninterest expenses fell $1.7M QoQ to $56.9M

The sequential decline in net income from Q3 2025 ($39.5M) was due to $13.4M lower noninterest income, as Q3 included one-time benefits from a $6.6M employee retention tax credit (ERTC) and a $3.5M pension plan curtailment gain.

What Is Driving NIM Expansion?

Net interest margin is the headline story. ConnectOne's NIM expanded for the fifth consecutive quarter, reaching 3.27% — up 41 bps from a year ago.

Key drivers:

- Deposit costs declining: Average cost of deposits fell 14 bps QoQ as the rate environment eases

- Subordinated debt refinancing: 38 bps decrease in cost of subordinated debentures following September 2025 refinancing

- Stable loan yields: Portfolio yield held steady despite rate cuts, reflecting disciplined pricing

CEO Frank Sorrentino stated: "Our net interest margin is expected to continue its upward trend during 2026 with deposit and borrowing costs decreasing and loan yields increasing."

What Changed From Last Quarter?

Balance sheet highlights:

- Loans grew 5%+ annualized QoQ to $11.5B

- Client deposits grew 5%+ annualized

- Deposit quality transformation since FLIC merger:

- Non-interest-bearing demand: 17% → 21%+

- Brokered deposits: 12% of assets → just 6% today

How Is Credit Quality?

Credit trends remain solid with no material deterioration.

Nonperforming assets ticked up to $45.9M from $39.7M, but remain well below Q4 2024 levels ($57.3M). The ACL coverage ratio of 336% provides a substantial cushion.

Criticized and classified loans improved to 2.49% of loans from 2.57% in Q3.

What Did Management Say?

CEO Frank Sorrentino opened the call with a strong characterization of the year:

"2025 was the defining period for ConnectOne, one that demonstrated the strength of our business model, the value of our client-first culture, and our team's ability to execute on all fronts."

On competitive positioning:

"With a strong balance sheet, a top-tier team, expanded footprint, a 21-year track record of strategic execution, and growing market dynamics, we've never been more competitively positioned."

CFO Bill Burns was equally bullish:

"I do believe we are well positioned to deliver best-in-class results while continuing to capitalize on prudent growth opportunities. And that, to me, makes our stock one of the most compelling investment opportunities out there."

What About Branch Rationalization?

ConnectOne announced 5 retail branch closures expected in Q1 2026, resulting in $1.3M of charges in Q4 2025.

This continues the post-merger optimization as the company integrates the FLIC franchise. The closures should drive further efficiency improvements and support the operating efficiency ratio, which improved to 45.3% from 47.5% last quarter.

How Did the Stock React?

CNOB shares traded at $27.85 as of market close on January 28, 2026, down 0.6% heading into the earnings report. The stock is:

- Up 35% from its 52-week low of $20.61

- 5% below its 52-week high of $29.28

- Trading at 1.18x tangible book value ($23.52)

The stock has gained meaningfully since the FLIC merger closed in Q2 2025, reflecting improved profitability metrics and NIM expansion.

Full-Year 2025 Results

The EPS decline reflects share dilution from the FLIC merger (stock-based consideration). On a per-share basis, the merger has been accretive to operating earnings momentum and tangible book value.

Capital and Dividend

Dividend declared: $0.18 per common share, payable March 2, 2026 to holders of record February 13, 2026.

Key Risks and Watchpoints

- Interest rate sensitivity: While NIM is expanding now, a prolonged low-rate environment could eventually pressure yields

- CRE concentration: Commercial real estate (including multifamily) represents ~70% of the loan portfolio — worth monitoring given sector headwinds

- Integration execution: While management says FLIC integration is complete, realizing full synergies takes time

- Credit normalization: NPAs ticked up sequentially; continued monitoring warranted

What Did Management Guide for 2026?

CFO Bill Burns provided unusually specific guidance on the call:

Net Interest Margin:

- Q1 2026: Up ~5 bps to low 330s

- +5 bps for every 25 bps Fed rate cut (uncertain if 1 or 2 cuts in 2026)

- +5 bps per quarter from loan repricing (kicks in mid-year, Q3/Q4)

- -5 bps potential from preferred redemption in Q4 (would improve EPS)

- Year-end target: 335-340 bps (assumes ~1 rate cut)

Operating Expenses:

- 4% increase by Q4 2026 vs current quarter

- Branch closures won't take effect until end of Q1

- Staff changes mid-year; expenses step up more in Q1, then flatten

Balance Sheet:

- Loan growth: 3-5% (more modest due to elevated payoffs from repricing)

- Deposit growth likely similar to loan growth

- Cash balances to be deployed into loans

Other Items:

- Provision: $5-6M per quarter expected

- SBA loan sale gains: >$4M in 2026

- Tax rate: 28% effective rate

- Loan pipeline: $600M at 6.2% weighted average rate

What About Capital Return and M&A?

Management provided clear capital allocation priorities on the call:

Capital Targets:

- Targeting 9% TCE ratio (currently 8.62%)

- Once reached: dividend increases, share repurchases, M&A optionality

- Tangible book value expected to return to pre-merger levels within one year of June 2025 close

M&A Strategy:

- Focus on New York Metro market (100-150 mile radius of NYC, ~2 hour drive)

- Also considers Southeast Florida part of their natural market

- M&A activity "heating up" but remaining financially disciplined

- Will compare IRR of acquisitions vs stock buybacks

CEO Frank Sorrentino on M&A: "There's a lot more activity going on in the marketplace for a variety of reasons, but I don't think that really changes very much the way we look at M&A... we're focused pretty much in market and, again, looking to be very disciplined around what makes sense for us to do."

How Is ConnectOne Using Technology?

CEO Sorrentino addressed AI and technology efficiency on the call:

"We've incorporated a number of leading technologies in the company going back years, and many of those are taking advantage of AI... every vendor, every partner we have is incorporating artificial intelligence into their systems, which is just naturally making a lot of the processes better."

"We can grow the balance sheet without significant additions other than revenue-producing people... all of the back office functionality and the ability to serve our clients is just getting more efficient in every single thing we do."

The result: ConnectOne remains in the top 1% of all banks nationally for efficiency ratio, even after dramatically expanding their retail branch presence through the FLIC acquisition.

Q&A Highlights

On deposit competition (Tim Switzer, KBW):

- Competition has "heated up"

- Monitoring carefully; margin guidance accounts for this pressure

On loan repricing pressure (Matt Breese, Stephens):

- Seeing some borrowers pay off rather than accept higher contractual repricing rates

- Actual repricing benefits may be lower than contractual models suggest

- Management taking conservative approach to guidance

On credit quality (Mark Fitzgibbon, Piper Sandler):

- NPA uptick was one multifamily loan relationship

- A January 2026 workout brought nonaccruals back down to prior levels

- Provision reduction partly non-recurring (CECL model improvements, PCD loan workouts above merger marks)

On Long Island franchise (Mark Fitzgibbon):

- Seeing "early gains in deposits" from Long Island

- Additional product opportunities with former FLIC clients who weren't offered ConnectOne's full suite

Bottom Line

ConnectOne delivered a clean beat driven by accelerating NIM expansion and disciplined expense management. With the FLIC merger integration complete, the company is demonstrating improved operating leverage — operating ROTCE jumped to 14.27% and the efficiency ratio fell to 45.3%. Credit quality remains solid despite a modest uptick in NPAs (one multifamily relationship, since worked out in January).

Management provided unusually specific 2026 guidance: NIM to 335-340 bps by year-end, 3-5% loan growth, 4% expense increase, and $5-6M quarterly provisions. The setup looks favorable with continued NIM tailwinds from rate cuts and loan repricing, though deposit competition bears watching.

At 1.18x tangible book, the stock offers reasonable value for a bank generating mid-teen returns on tangible equity, with optionality from M&A and capital return as TCE approaches 9%.

Conference call: January 29, 2026 at 10:00 AM ET. Dial-in: 1 (646) 307-1963, access code 8645811.

Related: